Table of contents

ToggleIntroduction

For several years now, dark trading has been on a meteoric rise, reaching record levels. In January 2025, over 51% of trading in the United States took place outside public markets, illustrating the rise of dark pools. Yet these alternative trading platforms remain largely unknown to the general public. At the crossroads of institutional finance and market regulation, they arouse both fascination and controversy.

In this article, we delve into the heart of this discreet universe to answer several key questions: What is a dark pool? How does it work? What is its history? Who are the main players? And above all, what impact could the rise of these hidden markets have on global finance?

1. What are Dark Pools ?

As their name suggests, dark pools are private, over-the-counter asset trading systems. The name comes from the lack of transparency in this type of market. Their definition implies three fundamental points: the confidentiality of exchanges, the value of exchanges and the players involved.

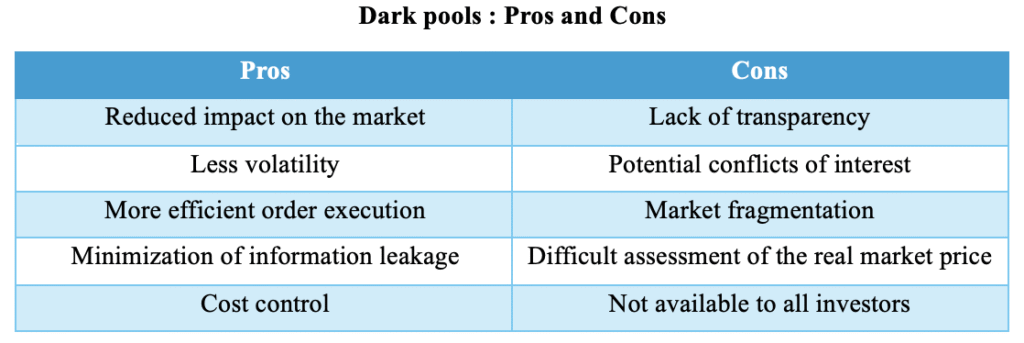

This confidentiality, which is often compared to opacity, is specific to these markets, and is one of the main reasons for their existence. The aim of this parameter is not to divulge transaction details, in particular price and volume, until the final transaction has been executed and confirmed. Unlike on-exchange trading, there is no publicly visible order book in dark pools. This allows some investors to keep their intentions secret while searching for a buyer or seller. The aim is to avoid the impact that large trades can have on the market, causing pricing problems and anticipatory overreactions.

The value of trades is also one of the characteristics of this type of market, and is directly linked to the players involved. These trades generally take place using “block trading”, i.e. a tool that enables large positions to be managed without affecting the market. The vast majority of the players involved in these trades are institutional, due to the size of the exchanges, but also to the complexity and exclusivity of these private trading systems.

Another advantage of dark pools is the predictability of trades, since negotiations take place at predetermined prices. This ensures that traders can trade under pre-determined conditions, with little or no volatility.

These exclusive markets also have a number of shortcomings, the first of which is a lack of transparency that runs counter to a fundamental value of stock markets: the free flow and assimilation of information guarantees an efficient market. This asymmetry can lead to problems, particularly if a large proportion of transactions take place on darks pools, since the price on public exchanges may not reflect the real market.

The exclusive and private access of darks pools creates a preponderance for conflicts of interest and risks of manipulation. Indeed, in the event of divergent interests, an institution could deliberately conceal the true market price. Certain players may also engage in fraudulent practices, such as overloading dark pools with false bids (quote stuffing) or exploiting latencies in order execution to gain an advantage.

2. The story of finance's shadow market.

The history of dark pools began in the USA in the 1990s, when the country’s major financial institutions sought to carry out high-volume transactions with minimal impact on the public market. On the largest American stock exchanges (NYSE and NASDAQ), an overly large order could lead to a market effect, causing prices to fluctuate even before the order was executed.

To avoid these market failures, investment banks set up systems known as “block trading desks”, enabling major institutions to trade directly with each other outside the traditional stock markets.

In the early 2000s, dark pools proliferated thanks to the boom in electronic trading and market fragmentation. Their consecration came in 2005 in the USA, when Regulation NMS (National Market System) encouraged their expansion by making it easier to fragment transactions between different alternative platforms. The result was as expected, with trading volumes in dark pools exploding.

In the wake of the subprime crisis, the early 2010s were marked by controversy and criticism. The growing success of these alternative markets attracted the attention of regulators and the financial media. The most frequently cited criticisms were the advantages of high-frequency trading (HFT) in this type of environment. Some HFT firms have been accused of having privileged access to information on orders executed in dark pools, enabling them to exploit opportunities at the expense of other investors.

These controversies have been the subject of numerous investigations and even sanctions. In 2016, Barclays and Credit Suisse reached an agreement with the US Securities and Exchange Commission (SEC) to settle a dispute concerning their dark pools. The two banks had to pay $154.3 million after failing to inform customers about the operation of these markets. Barclays also allegedly misled investors by claiming that they would be protected from the hostile maneuvers of high-frequency traders.

Faced with this criticism, regulators in the US, Europe and Asia have imposed stricter rules on dark pools. In Europe, MiFID II (2018) introduced limitations on trading volume in dark pools to prevent them from cannibalizing public markets too much.

Despite this increased regulation, dark pools continue to be a key tool for institutional investors, and their market share continues to grow.

3. Its many players !

Dark pools are set up by various players in the financial world. Firstly, there are the dark pools set up by investment banks and institutional brokers. These players have their own markets for executing client orders or their own transactions, and are mainly used by institutional funds (pension funds, Hegde funds, asset managers) to place large orders with complete discretion. The main ones are Goldman Sachs’ Sigma X, Morgan Stanley’s MS Pool and J.P. Morgan’s JPM X.

Some major traditional exchanges also offer their own dark pools to capture some of this alternative liquidity. Examples of exchange-operated dark pools include NYSE dark pool, NASDAQ PSX and BATS dark pool.

Other alternative exchanges have also emerged to take advantage of this growing market and offer anonymized access to certain liquidities. The aim of institutions using this type of dark pool is to avoid the volatility of the public markets. The most important players in this segment are Liquidnet and Instinet.

Last but not least, we can’t mention dark pools without thinking of high-frequency trading (HFT) firms. Some of these firms operate or actively participate in dark pools with the aim of capturing liquidity and arbitrating price differences between public and private markets. These firms use ultra-fast algorithms to detect trading opportunities in dark pools. They are often criticized for their potentially negative impact on market fairness. Examples of HFT firms present in dark pools include Citadel Securities, Virtu Financial and Jump Trading.

Conclusion

In conclusion, dark pools have many advantages, but also a number of shortcomings, some of which are the precursors of their regulation.

The rise of dark pools illustrates the transformation of financial markets towards a more fragmented structure, where confidentiality and transaction efficiency are prioritized at the expense of transparency. While these platforms offer undeniable advantages for institutional investors, they also pose challenges in terms of regulation, fairness and market integrity. The rise of algorithmic trading and high-frequency firms raises questions about the future of these parallel markets and their long-term impact.

With regulations such as MiFID II in Europe and increased oversight in the United States, the legal framework around dark pools could evolve further to limit abuses while preserving their role in the financial ecosystem. Could the emergence of blockchain technologies and asset tokenization offer a more transparent alternative to dark pools? The future of financial markets will probably be played out in a balance between innovation and regulation, where the quest for liquidity and efficiency will have to come to terms with the imperatives of transparency and stability.